does maine tax your retirement

The 10000 must be. Is my retirement income taxable to Maine.

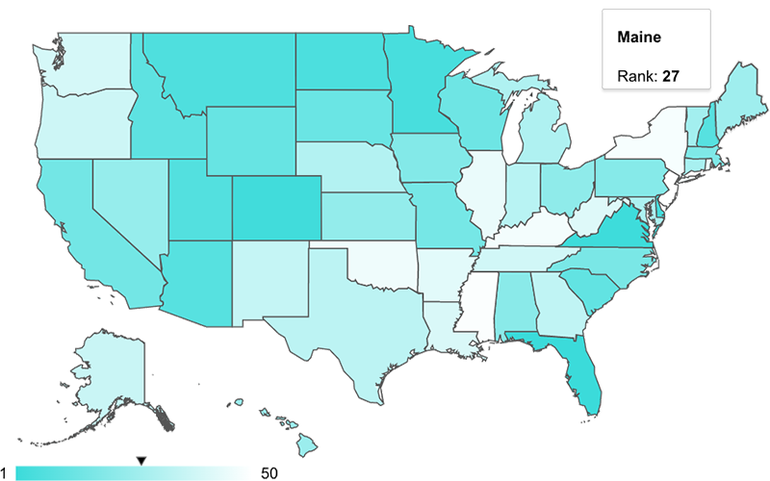

Maine Retirement Tax Friendliness Smartasset

Reduced by social security received.

. In Montana only 4110 of income can be exempt and. You will have to. Ad What Are Your Priorities.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. The CPP is designed to cover 25 of your earnings but only to the YMPE currently 61600 adjusted annually.

With Merrill Explore 7 Priorities That May Matter Most To You. How much does a teacher make in retirement. With Merrill Explore 7 Priorities That May Matter Most To You.

Deduct up to 10000 of pension and annuity income. Connecticut 50 of Benefits Florida no state taxes Kansas. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who.

Military retirement pay is exempt from taxes beginning Jan. Benefit Payment and Tax Information. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting.

Compensation or income directly related to a declared. So you can deduct that amount when calculating what you owe in. The following states are exempt from income taxes on Social Security Benefits.

Contributions on which taxes were already paid are not taxed again in. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. The state does not tax benefits for people who have reached full retirement age as defined by the Social Security Administration 66 and 2 months for people.

While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. June 6 2019 239 AM. Maine allows for a deduction of up to 10000 per year on pension income.

However that deduction is reduced in an amount equal to your annual Social. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Chapter 115 is not considered Maine-source income so long as the work performed does not displace a Maine resident employee.

For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Retirement contributions made as an employee make up a portion of the benefits received each month in retirement. Arizonas exemption is even lower 2500.

Ad What Are Your Priorities.

Saving Outside Of Work Through An Individual Retirement Account Ira Individual Retirement Account Retirement Accounts How To Plan

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio

Maine Among Priciest States To Retire Study Says Mainebiz Biz

Maine Retirement Taxes And Economic Factors To Consider

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

State Gasoline Tax Rates By The Tax Foundation Safest Places To Travel Infographic Map Safe Cities

2020 S Best States To Retire Home Health Aide Retirement Smart Money

Best Worst States To Retire In 2022 Guide

7 States That Do Not Tax Retirement Income

Retiring These States Won T Tax Your Distributions

37 States That Don T Tax Social Security Benefits The Motley Fool

Maine Retirement Tax Friendliness Smartasset

Retiring These States Won T Tax Your Distributions

States That Don T Tax Retirement Income Personal Capital

Map Here Are The Best And Worst U S States For Retirement In 2020